Heads up: This post may contain affiliate links. That means if you click and purchase, I might earn a small commission- at no extra cost to you. I only recommend stuff I actually use, love, or would fight a bear for. Thanks for keeping the lights on.

The moment anything comes up about money or speaking with someone to help me better my situation, the floodgates of fear open and I feel like I completely shut down. Sound familiar? If you’re dealing with financial anxiety like I am, you’re definitely not alone, and there’s actually help available, even when it feels impossible to reach for.

When Money Anxiety Symptoms Take Over Your Day

To ask for help makes me feel worthless and little. When I can’t pay bills, I know I could have done better in past spending sprees and had the money if I hadn’t gone ham trying to learn how to make more money. These are classic money anxiety symptoms that I’ve been wrestling with, and maybe you recognize them too.

Today was one of those days where so many fears around money hit at once. I thought my student loans were coming up for payments, and I found one of my credit cards has a payment plan that would cut the monthly payment substantially while halting the interest. All good things for someone looking for financial stress relief, right?

The Weight of Student Loan Anxiety

Then why do I feel so small? Why has my entire demeanor changed once I started tackling these tasks today? The single thought of doing these two simple money tasks wiped me out so much that I literally had to lay down for 15 minutes just to get my bearings in place. Student loan anxiety is real, y’all.

The funny thing is, when I called the student loan company, the representative I spoke with was super cold from the get-go while identifying me, then actually warmed up when informing me my payments were still zero dollars for at least the next year.

I know I’m sensitive and I know I worked myself up prior to the call. But even after finding out I don’t have $500 monthly payments starting up any time soon, I still feel like there’s a catch. I still feel heavy, like I’m not doing my part because I can’t afford the money I took out for the career I thought I wanted to do for the rest of my life.

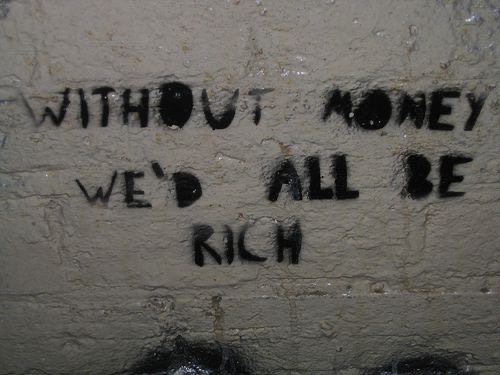

Recognizing the Money Shame Spiral

I see how I am just being super hard on myself right now. I see where I’m holding onto this feeling of worthlessness for no reason, and I understand that I need to sit with it. This is what overcoming money shame actually looks like. Not the Instagram-perfect version, but the messy, real process of catching yourself in the spiral.

Typing this out is helping me get my feelings out. Literally moments before I started writing, I was curled in a ball of fear, frozen on what to do next. Now I sit here crying, grateful to release the madness I was starting to spiral down into.

I could sit here and type all kinds of excuses about why I should have the money, all kinds of justifications for why I shouldn’t have to pay it back. I could speak the hot air of rationalization in whatever direction I wanted. But just sitting here and understanding what I’m feeling is actually calming me more than trying to find a way out.

Research shows that financial stress can trigger the same physiological responses as physical danger, which explains why my body literally shut down at the thought of making those calls.

The Reality Check at 36: Starting Over Isn’t Failure

I am still so mad at myself for not having my shit together at my age. I’m 36 and starting over from scratch, and for some reason I feel like I should be a master at this new life I’m creating. This new life I’ve never lived before, these habits and awarenesses that I’ve never paid attention to or practiced before.

It’s really silly when I type this out. How can someone, anyone, be a master at something they’re brand new at? That’s preposterous, and no one would expect this of anyone else. So why would I expect this from myself?

This is where money mindset healing really begins, with that moment of recognition that you’re being unreasonable with yourself. If you’re struggling with similar thoughts, the National Foundation for Credit Counseling offers free financial counseling that can help you work through these feelings alongside practical solutions.

What Financial Stress Relief Actually Looks Like

I need to drop the expectation of being perfect. I need to drop the expectation that because I’ve been on this earth longer than some, I should somehow be knowledgeable about everything I come across. At any age, when you begin something new; whether it’s a new journey, new habits, a new lifestyle, anything new; it takes time to adjust and become accustomed to what’s expected.

The fear of the unknown can get our imaginations running wild, and it’s up to us to recognize when that spiral of doom is occurring so we can stop it in its tracks. Mental health professionals call this “catastrophic thinking,” and the good news is there are proven techniques to interrupt these patterns. I feel good about releasing through this writing, whether I post it or not. It’s definitely brought me back to myself, and I’m grateful to have used this tool for such a shift in such a short amount of time.

Finding Balance When You’re “Not Doing Enough”

I’m still stuck in a mindset that I’m not doing enough, that I need to be more disciplined in my daily actions. But I also know how frantic I was when trying to do too much, and I’m still finding the balance between being productive and just being busy.

I have my list of what’s mandatory for this week. Although I planned on marking two things off today, I think I’ll stick with one. The app froze when I tried to accomplish the second task, and I still have a week before its deadline. So actually, I am being productive on certain things. Now I realize there are more important things I’m putting off that should be at the top of the priority list.

Again, I’m grateful to have just realized this.

The Breakthrough Moment: Self-Compassion Over Perfection

I am proud of myself. I’m proud that I’m working through this financial anxiety, proud that I’m clearly processing while typing this out. I’m grateful for the clarity and the realization of what I’m feeling, and that I’m actually doing a good job at this new way of adulting.

All we can do is give ourselves grace and do our best while recognizing that things take work and effort and become easier as time goes on.

I’m grateful for this journey to become a more efficient person, a real adult if you will. It’s growth, and it can only be taken one step at a time. I still want to crawl back into bed and nap again, turn on a Disney movie and color in my coloring book. But it’s 3:30pm, and since I already napped earlier, I’d never sleep tonight if I napped again. It’s far too early to get back into bed when I have plenty of studying to do to tighten up my trading for tomorrow.

Your Action Plan for Financial Anxiety Help

If you’re reading this and nodding along, here’s what I’ve learned actually works:

Face the fear head-on. Look it in the face and don’t back down. Talk it out, feel it out, dive into yourself and understand why you feel like a gnarly cloud just surrounded you and what you can do about it.

Don’t wallow in discomfort. Sitting and wallowing doesn’t accomplish anything productive. Taking a moment to understand what you’re feeling and why, while also letting it go and knowing you’re doing your best, that’s been one of the best tactics I’ve ever discovered.

Use writing as a release. This short writing session has helped so much. I don’t even feel like getting back into bed at this moment, even though I was literally thinking about it three minutes ago. I feel refreshed and excited to turn on a new lesson, take notes, and learn something new that will get me closer to my goals. Studies have shown that expressive writing can significantly reduce anxiety and improve emotional regulation.

You’re Not Alone in This

Whether you’re dealing with student loan anxiety, general money anxiety symptoms, or working on overcoming money shame like me, remember this: Take care of yourself and be nice to yourself. You are the only person you truly have to live with.

And if you’re starting over at 36, or 46, or any age, that’s not failure. That’s courage. That’s growth. That’s exactly what financial stress relief looks like in real life: messy, imperfect, and absolutely worth celebrating.

Have you experienced similar financial anxiety? What helps you work through money shame spirals? I’d love to hear your thoughts and experiences in the comments below.

Frequently Asked Questions About Financial Anxiety

Q: Is financial anxiety a real mental health condition? A: Yes, financial anxiety is a recognized form of anxiety that affects millions of people. It can manifest as physical symptoms (panic attacks, insomnia, headaches) and emotional symptoms (shame, fear, overwhelm). While it’s not a standalone diagnosis, it often co-occurs with other anxiety disorders and depression.

Q: Why do I feel so ashamed about money problems? A: Money shame often stems from societal messages that equate financial success with personal worth. Many of us learned early that struggling with money means we’re “failures.” This shame keeps us isolated and prevents us from seeking help. But remember, financial struggles are incredibly common and don’t define your value as a person.

Q: How do I know if my financial stress is “normal” or if I need professional help? A: If financial worries are interfering with your daily life, relationships, sleep, or work performance, it’s worth speaking to a professional. Warning signs include: avoiding all money-related tasks, panic attacks when thinking about finances, relationship conflicts over money, or using substances to cope with financial stress.

Q: What’s the difference between being financially responsible and having financial anxiety? A: Financial responsibility involves thoughtful planning and reasonable concern about your financial future. Financial anxiety involves excessive worry that’s disproportionate to your actual situation, causes physical symptoms, and prevents you from taking productive action.

Q: Can financial anxiety affect my physical health? A: Absolutely. Chronic financial stress can lead to headaches, digestive issues, high blood pressure, weakened immune system, and sleep problems. The mind-body connection is real, and addressing financial anxiety often improves physical symptoms too.

Ready to Take Your Next Step?

If this post resonated with you, you’re not alone in this journey. Thousands of people are working through similar financial anxiety every day, and there’s absolutely no shame in seeking support.

📧 Subscribe & join my newsletter where I share real, honest updates about my journey, the messy moments, the breakthroughs, and the practical strategies I’m discovering along the way. No perfect Instagram moments, just authentic stories from someone who gets it.

Remember: Starting over at any age isn’t failure, it’s courage. And every small step you take toward financial wellness, even when it feels scary, is worth celebrating.

What resonated most with you in this post? I’d love to hear your story, drop a comment below or hit reply when you get my emails.

Leave a comment